Email Invoice #1: Before the Invoice Is Due

According to Exim, 60 per cent of challans are paid late. One of the top reasons for late payments is bureaucracy. Part of a negotiating seminar training is learning how to address cultural problems such as excessive red tape.

A simple step to counter the effects of red tape is to send an invoice before payment is due. An invoice also works as a pro forma invoice before payment is due. A pro forma invoice serves as a bill of sales, a quote and an estimate.

An initial invoice serves to restate agreements reached during negotiations. You are essentially creating a summary for your customer of what the customer has agreed to buy and at what cost. Sending out initial invoices also allows businesses to streamline their internal approval processes. An early start on processing is more likely to lead to timely payments. The best time to send the first invoice is:

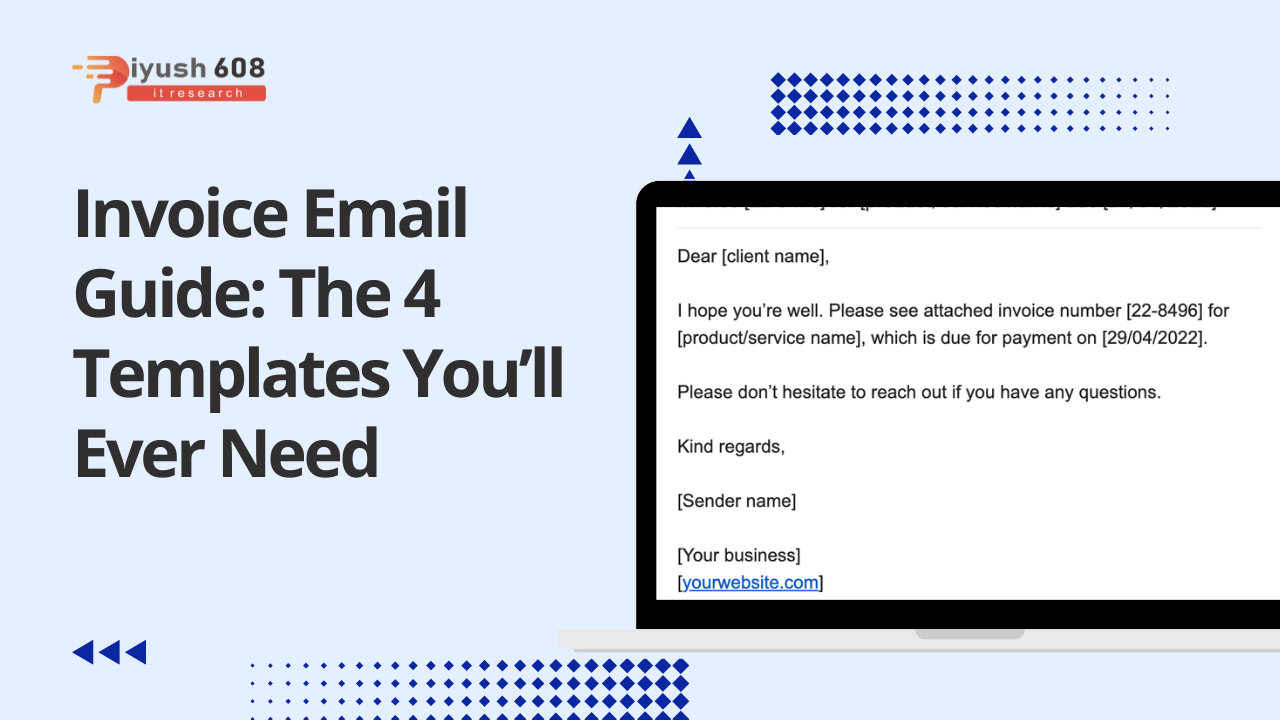

The invoice email template should contain:

- The subject

- Body

- Signature

- Attached invoice in PDF format

Subject: (Name of your business): Invoice # (Invoice Reference Number)

Hello (contact’s first name),

I hope business is doing well, and your plans for (Contact’s business goal) are on track.

I’d like to leave a quick note to remind you that (invoice amount) will be due on (due date) payment for our invoice # (reference number).

Can you confirm that all the details are correct as per our contract? It will be useful to know that everything is on track for payment. Will I need to CC any other department on (customer’s business/organization name)?

best regards,

(Your name)

(Signature)

An effective subject line is clear and concise. Your contact needs to know what the email is about, or they may send your email to spam without reading it. If the person receiving the invoice is not familiar with your company as the new supplier of your business, the email may be deleted.

In the body of the email, a personal opening line is a great way to meet your customer’s aspirations professionally.

Wrapping up the email asking for confirmation of details

s tries to correct any errors in the invoice. You also want to make sure that you are sending the invoice to the correct person/department.

Your contact is prompted for an answer, ending with one or two simple questions. With Reply, you can check that your email has arrived and has been read by the recipient.

Email Invoice #2: On the Due Date

Like the first email invoice, of course, be professional and friendly when sending a due date invoice. State the total amount due along with the due date, specifying any prepaid amounts. Include a thank you note appreciating the company for its business.

In the invoice, include any line items that you agreed to during the negotiation. Be sure to include all the details of the discounts, taxes and other payment terms negotiated to increase the chances of timely payment of the invoice. An email invoice on the due date might look like this:

Subject: (Your business name): Invoice #(invoice reference number)

Hi (contact’s first name),

Thanks for your business. Please find attached your invoice from (your company name) for Invoice #(invoice reference number) for (invoice amount).

Kind regards,

(Your first name)

(Signature)

A due date invoice email reminds the customer to honor their obligation. The due date invoice also serves as a record for your customer’s accounting entries. Dialogue seminar leaders advise that clear and concise messages produce the best results when it comes to securing payments.

Email Invoice #3: In Early Overdue

To maintain consistent cash flow, you don’t want your customers to slip into late payments. In early overdue, you want a firm commitment to pay off as soon as possible.

You also want your customers to be aware of late payment fees and penalties. Make sure any fees and penalties are part of the negotiated contract. An early overdue email invoice template might look like this:

Subject: (Your business name): Invoice #(invoice reference number) Due: (past date)

Hi (contact’s first name),

I hope all’s well.

We are yet to receive payment of (invoice amount) for our invoice #(invoice reference), which was due on (due date).

The invoice is now seven days past due date since (due date) with a balance of (balance amount). A seven-day delay attracts a 1.5% late fee as per our contract. When can we expect payment on the balance?

You can pay by (insert preferred payment method). Please contact our accounts manager (name & phone/email) if you need further assistance. We look forward to your swift response.

Kind regards,

(Your name)

(Signature)

In early overdue, you want to give your contact the benefit of the doubt. They may have already sent the payment, which is not reflected in your system. The contact is still pursuing the signatory for approval.

Another possibility, if we’re really giving the benefit of the doubt, is that the customer didn’t know how to pay. Therefore, provide your customer with payment options so as to prevent their early overdues from becoming late overdues.

Email Invoice #4: In Late Overdue

A late outstanding invoice email attempts to secure the payment date. The facilitator of the talk seminar recommends that you persevere. Tell the customer that it’s not okay for you to pay late. An approach that is too soft can lead to poor prioritization of overlooked payments.

Late overdue email adds some urgency to invoices. The email may refer to legal ramifications. A late-overdue template might look like this:

Subject: (Your business name): Invoice #(invoice reference number) OVERDUE

Dear (contact’s first name),

I hope all is well at (customer’s company name).

We are yet to receive payment for Invoice #(reference number) for (amount) due on (due date). The invoice is currently (number of days) overdue.

I’m reaching out to find out if there is any way we can assist in getting the payment processed. The long-overdue amount has become problematic for our accounting department and are now considering forwarding to our collection service for action.

You can pay by (insert preferred payment method). Please contact our accounts manager (name & phone/email) if you need further assistance. As a matter of urgency, could you get in touch and let us know when to expect payment?

Kind regards,

(Your name)

(Signature)

To be effective, the late-overdue email uses strong words while still offering support. If you’d like some additional help in this or similar situations, thankfully, an online negotiating platform can prepare credit managers to handle payment disputes.

Back on our email, the first line asks about the contact’s company, trying to find out if there are internal problems causing the delay in payment. Most businesses would like to maintain the reputation of being a running entity. Telling the customer that the next step will be the collection service process increases the likelihood of a quick response that leads to payment. Top website designer

+91 7905834592

+91 7905834592

Enquiry Now

Enquiry Now

piyushmnm@gmail.com

piyushmnm@gmail.com

piyush.gupta384

piyush.gupta384

Reviews

There are no reviews yet. Be the first one to write one.